Less is more

In investing, less is often more. Unlike in many areas where action yields results, frequent trading can weaken a portfolio. Timing the market is challenging in an efficient market where information is swiftly reflected in asset prices, making a minimalistic approach a wise strategy for long-term success.

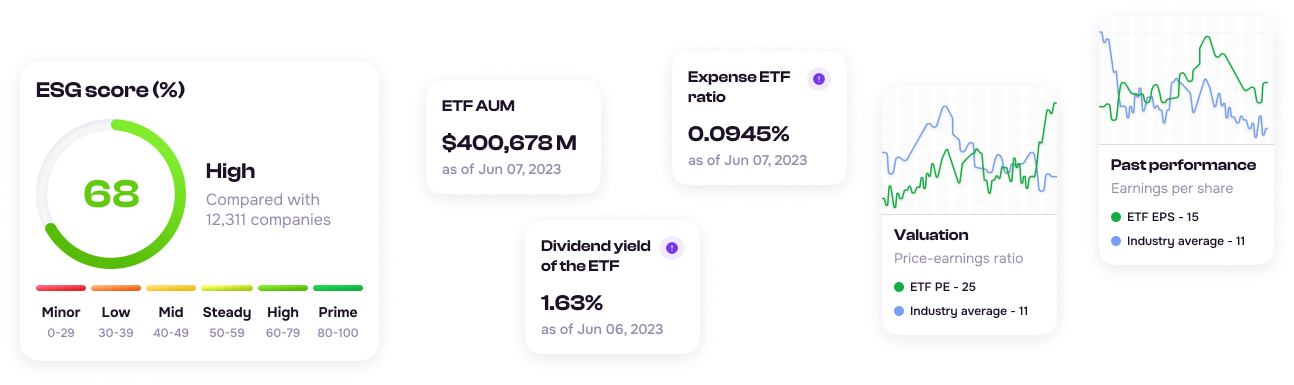

What is an ETF

An ETF, or Exchange-Traded Fund, is a type of investment fund that holds a collection of assets like stocks, bonds, or commodities, and is traded on stock exchanges just like individual stocks. It offers diversification and lower fees, making it a popular choice for both beginner and seasoned investors

The power of ETFs: your path to diversification

Instant diversification

Exchange-Traded Funds (ETFs) offer immediate diversification, mitigating risk by providing exposure to a variety of assets and preventing overreliance on a single investment.

Risk reduction

ETFs play a pivotal role in minimizing risk by allowing investors to avoid concentration in a specific asset, thus promoting a more balanced and resilient investment strategy.

Market Liquidity

ETF liquidity allows for quick and easy trading, similar to stocks, enabling investors to buy and sell shares rapidly at market-determined prices throughout the trading day. This flexibility helps in managing investment positions and executing strategies efficiently.

The reality of picking individual stocks

We understand the allure of picking individual stocks, but let's look at the facts. The truth is that stock picking can be a risky endeavor, especially for the average user and beginners.

Inherent risk

Picking individual stocks carries higher risk due to the lack of diversification, exposing investors to the volatility and potential underperformance of single companies

Evidence-based caution

Stock picking is fraught with risk, as demonstrated by the SPIVA scorecard report, where over 90% of hedge funds failed to outperform market indices.

Market index superiority

The SPIVA report underscores the difficulty, even for skilled money managers, in surpassing market index performance, highlighting the potential benefits of passive investment strategies like ETFs.

93% of large fund manager undeformed the S&P 500 over the past 20 years. Only 7% were able to beat the market.

— SPIVA US scorecard —

The case for index fund investing

Index fund investing isn't just arguably the most suitable investment strategy; it's a proven one for most retail investors with long-term horizons. By aligning your investments with broad market indices, you can enjoy the benefits of diversification, reduced risk, and the potential for consistent growth.

Exploring themes & sectors

While we strongly advocate for index fund investing, we also recognize that some investors may seek additional returns above the market return. That's why we offer you the flexibility to allocate a certain percentage of your portfolio to specific sectors or themes that align with your investment goals.

Unlocking opportunities for all

Sharia-compliant ETFs are designed to meet the ethical and financial principles of Islamic law (Sharia), making them suitable for Muslim investors. These ETFs follow specific guidelines, such as avoiding investments in businesses related to alcohol, gambling, pork, and interest-based financial services. Instead, they focus on sectors and companies that align with Islamic principles.

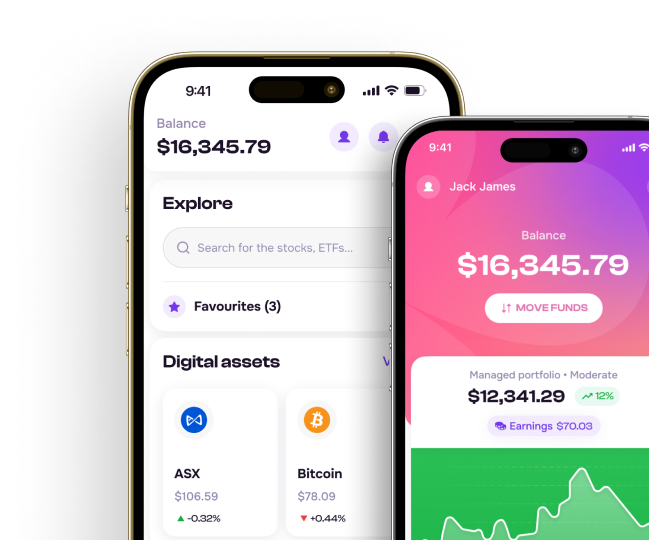

Start Your Investment Journey with Spike Invest

We provide the tools, resources, and insights to help you understand the world of ETFs and make informed decisions. Whether you're just starting out or looking to fine-tune your strategy, Spike Invest is your partner in building a solid financial future.

Get started

Join Spike Invest today